Index Liquidity with T Markets

A stock index serves both as a benchmark and a tradeable asset, reflecting the performance of a group of leading companies.

These companies are selected based on factors such as market capitalization, trading volume, sector, and listing exchange.The calculation methodology varies by indeks, for example, the S&P 500 tracks 500+ U.S.-listed companies and is managed by a committee. Indices like the DOW30, NASDAQ100, and DAX40 offer exposure to major sectors and regional markets in a single position. For brokers and institutional providers, offering index CFDs allows clients to engage in broad market speculation without managing individual equities, enabling high- volume trading, diverse strategies, and simplified exposure through a single instrument.

Index CFDs - Institutional Advantages

Providing index CFDs through your brokerage or platform unlocks unique advantages for institutional clients and professional traders.

* Risk Warning: Trading in forex and CFDs could lead to a loss of your invested capital.

What We Offer for Index Liquidity

Multi-Platform Infrastructure

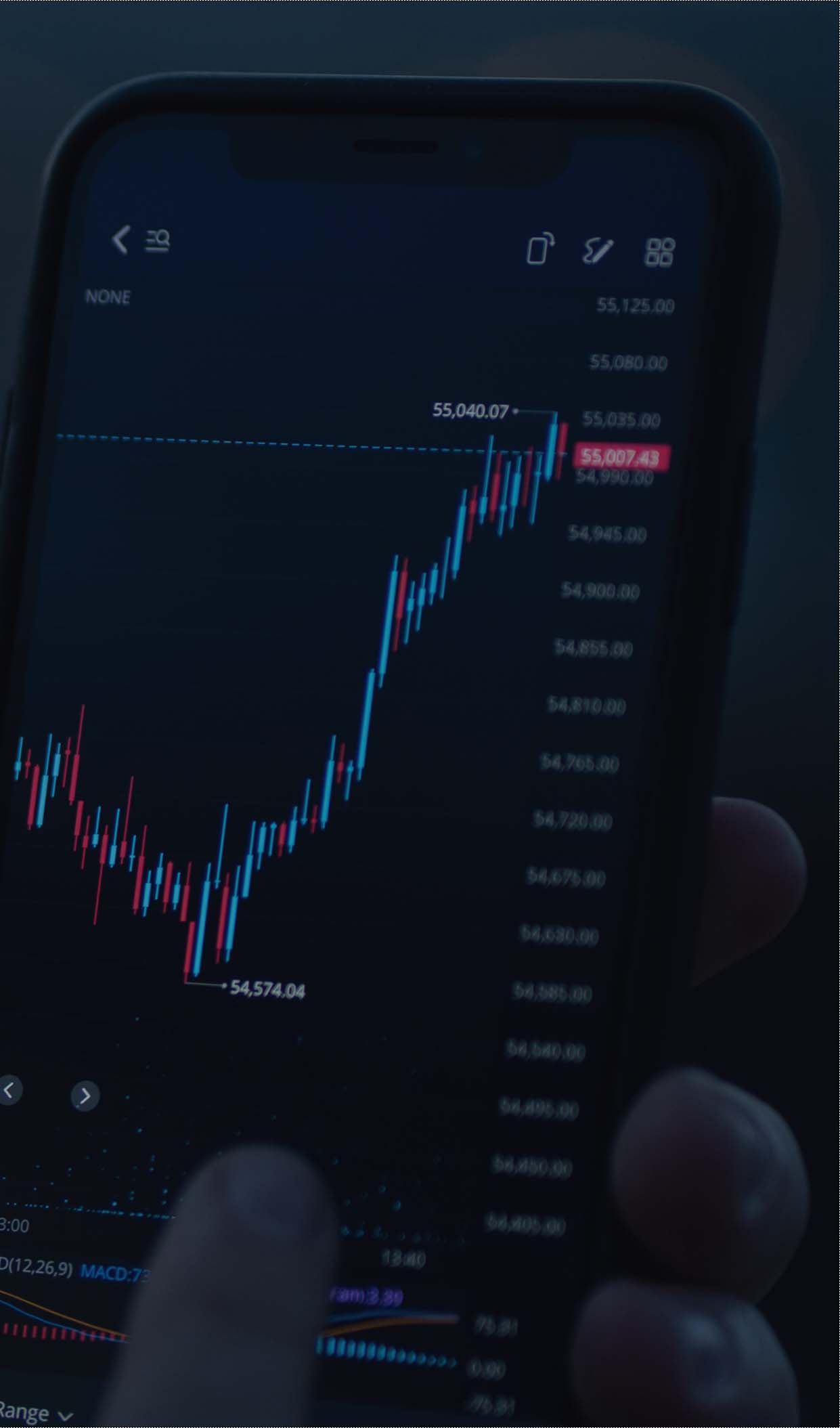

Deliver index CFD trading via MetaTrader 4, web terminals, or mobile apps—all branded or white-labeled to your brokerage.

Global Index Coverage

Offer your clients access to 20+ major indices across the US, Europe, and Asia, enabling geographic diversification and broader exposure.

Tight Spreads & Competitive Costs

Institutional-grade pricing with low commissions and tight spreads—optimised for high- volume execution and client retention.

Dedicated Support & Relationship Management

Partners receive ongoing support from our liquidity and integration teams. Eligible accounts gain access to relationship managers and technical assistance.

Institutional Account Tiers for Index CFD Trading

T Markets offers flexible institutional account models tailored to brokerages, white-label partners, and professional trading firms. Whether you're scaling an IB network or running a high-volume desk, our tiered structure adapts to your business model.

* Risk Warning: Trading in forex and CFDs could lead to a loss of your invested capital.

If you can’t find the right trading account, don’t worry. We’ve got more options waiting for you.

View all T Markets trading accounts

Getting Started: Join Our Liquidity Network

* Risk Warning: Trading in forex and CFDs could lead to a loss of your invested capital.

Institutional Platforms for Index CFDs

T Markets provides access to two robust platforms for executing index CFD strategies at scale. Whether you operate a branded white-label solution or connect via MT4 bridge, we support flexible, multi-device deployment.

MetaTrader 4

T Markets Trader

* Risk Warning: Trading in forex and CFDs could lead to a loss of your invested capital.

DAX30: Europe’s Leading Equity Benchmark for Institutional Markets

The DAX30 (Germany 30 Index) tracks the performance of the thirty largest and most liquid companies listed on the Frankfurt Stock Exchange. Since its launch on 1 July 1988, it has evolved into one of Europe’s most actively traded and widely recognized stock market indices.

T Markets enables brokers, financial institutions, and B2B partners to offer DAX30 exposure via institutional-grade CFDs—delivered through a robust trading infrastructure with deep liquidity, competitive pricing, and seamless integration. Enhance your product offering with access to a core European index trusted by professional traders worldwide.

Key Indices Available Through Our Liquidity Feed

US30 (Wall Street 30)

Tracks 30 of the largest U.S. companies, including Apple, Boeing, and Chevron. A core benchmark for American market sentiment.

DAX30 (Germany 30)

Germany’s flagship index representing the top 30 companies on the Frankfurt Stock Exchange — including Adidas, Bayer, and Lufthansa.

NASDAQ100 (US Tech 100)

Captures the performance of 100 leading U.S. technology and growth firms such as Amazon, Microsoft, and Meta.

FTSE100 (UK 100)

The most prominent U.K. index, covering top companies on the London Stock Exchange, including BP, Barclays, and Tesco.

S&P500 (US 500)

A diverse U.S. equity benchmark of 500 large-cap companies like Coca-Cola, AT&T, and American Express.

ASX200 (Australia 200)

Tracks 200 key Australian stocks including Qantas Airways and ANZ Group, offering exposure to the APAC region.

* Risk Warning: Trading in forex and CFDs could lead to a loss of your invested capital.

Diversify Your Brokerage Offering

Looking to expand your brokerage offering beyond indices like NASDAQ100 or FTSE100? T Markets enables institutional partners to deliver direct access to global equities, including shares listed on the NYSE, NASDAQ, LSE, and more - via CFDs.

Through our unified liquidity infrastructure, brokers can offer hundreds of tradable instruments across asset classes, all under one platform, with no need for additional setups or accounts.

Multi-Asset Access from One Platform

Our mission is to support brokerages and financial firms with a scalable, all-in-one solution for multi-asset trading. From stocks and indices to forex, metals, and soft commodities, everything is available through a single account and pricing engine.

Let your clients shift strategies or asset classes instantly - without operational friction.